Posted: 27 Jul 2011 02:19 PM PDT

…which is not good news for honest New Zealand investors trying to do a due diligence exercise; nor for the New Zealand Ministry of Economic Development’s reputation, if it has one; nor for the NZ Government’s promotion of

igovt.

First, though, a detour: the first stop on our trip to New Zealand is…Panama.

Panamanian lawyers, if they are not 100% scrupulous, can earn an easy living by promising fraudsters more confidentiality than Panama can actually deliver. From

Panama-Guide.com, here’s an article by Don Winner about the resonantly named pseudoreligious fraudster Quintin Sponagle:

…since I first published the original story about Quintin Sponagle, the guy who victimized 178 members of his own church and family to steal about $4 million dollars in a Ponzi scheme, I have received a bunch of emails and calls with additional information on his activities here in Panama. For example, he moved to Panama in 2006 when things got too hot for him in Nova Scotia. He apparently used the stolen money to establish several offshore corporations here in Panama in an attempt to cover his tracks – for example WATERNISH TRADING, INC. which is advertised as “C/O Sovereign Management Services, Avenida Ricardo J Alfaro Edificio Century Tower, Panama City, Panama, Panama, 260-4524.” That leads to a company called e-pharma24.com, and from there you can branch out into a whole network of online pharmaceutical companies all apparently owned by the same group and interconnected, but under a lot of different websites and operating names. This all ties back to another Panamanian Corporation called Miriad Inc.. Both Waternish Trading Inc. and Miriad Inc. have same resident agents and subscribers – Aknia Chi Pardo and Marga Quintanar de Calderon. If you then do a Google search on those two names, you will see how they are involved in literally dozens of companies, and their names pop up again and again on Internet forums of people trying to recover their money. Therefore, they are likely just setting up front companies for guys like Quintin Sponagle who are trying to hide behind a complicated web of offshore Panamanian corporations. And why would Quintin Sponagle want to hide the money he stole in Nova Scotia? Because Price Waterhouse is suing him for $1.8 million dollars.

I didn’t find that much about Marga Quintanar de Calderon, but when I looked into Aknia Chi Pardo, I hit the jackpot.

Here is another of Don Winner’s stories, from 2006, a dodgy Panamanian company shut down by the Canadian regulator; the company treasurer is Aknia Chi Pardo. And here is an

enormous list of all the Panamanian companies with which she’s associated in one capacity or another. She must be a very busy lady indeed, trousering all those service fees. If I were her I’d be concerned about who was paying me all that money and why.

If you relax your Google search criterion a bit, you get more hits. Here is plain

Aknia Chi, a lawyer in Panama, here’s the

same name cropping up in connection with a suspected scam, and here is

Aknia Mayn Chi Pardo, who, with her very un-Swedish name has somehow got the role of director of a Swedish company, Transocean Savings and Trust ekonomisk förening, that’s

going into bankruptcy (that’s what “Konkurs inledd” means); the sort of thing a scam front company does once it’s done it’s work, or failed to hook anyone. I wonder which it is.

So that’s the MO, and it sounds great, from the fraudster’s point of view, doesn’t it? You commit your fraud, then stash the proceeds in a web of Panamanian companies, or a company tolerated by a dopey offshore company register, like the Swedish one. The trouble is, fraudsters can’t necessarily rely on the lawyers to stay onside once someone’s called the cops. Don Winner again:

In Panama it’s relatively easy to penetrate the supposed cloak of secrecy surrounding these companies and corporations. As long as you’re not doing anything illegal, then you have a right to privacy and protection. However as soon as you’re doing something like trying to hide the $4 million dollars you stole in Nova Scotia from the members of your church, then any prosecutor will order full an investigation, together with full and complete disclosure. The lawyers who set these things up promise the moon when they are taking your money, but when the investigators from the Public Ministry come knocking they simply say “we didn’t know” and roll over like ducks on a pond. It’s actually a pretty good gig for the lawyers. And, there’s steady flow of new suckers like Quintin Sponagle who are willing to drop down some of their hard-stolen money to try to buy anonymity. And once you start penetrating one company, then you find bank accounts, and the bank accounts lead to other information, and before too long it’s all coming down like a house of cards, and Quintin Sponagle is on a plane for Ecuador.

So that’s my tip to the fraudsters: you can’t trust the Panamanian lawyers that you are dealing with. They are scamming

you. If they get into trouble, they will turn you in.

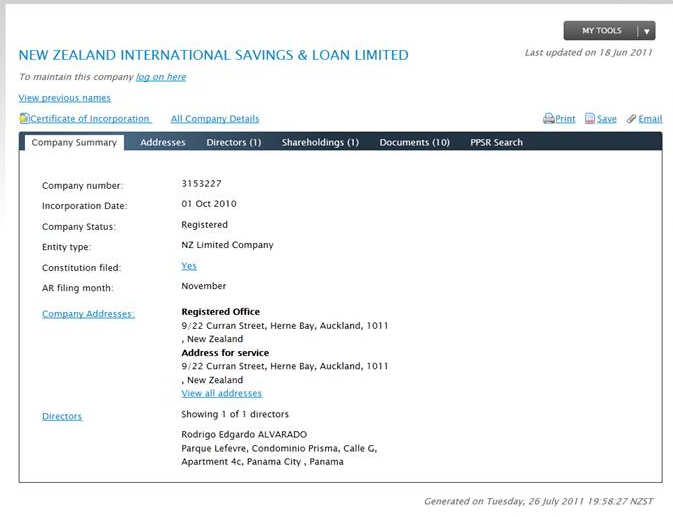

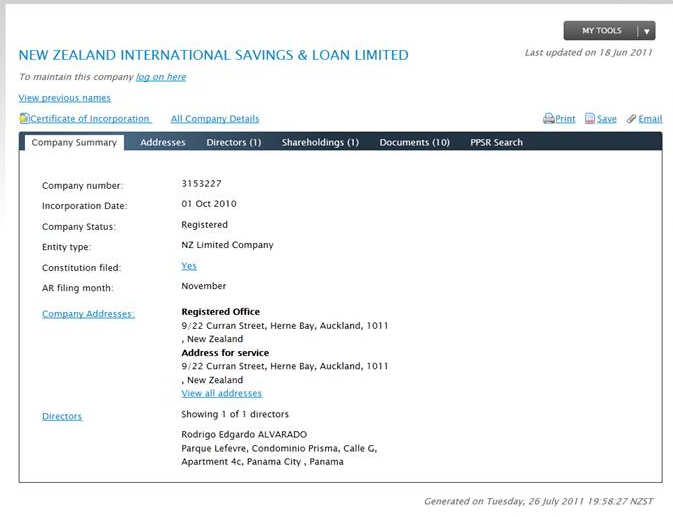

So much for Panama; what’s the New Zealand connection? Well, chasing Aknia Chi Pardo led me to New Zealand. And that got me started ferreting about in the NZ company register, looking for Panamanian connections. I found some. No-one expects a company register to be clean as a whistle – there will always be frauds and fronts in there. So this sort of garbage:

…is arguably not all that surprising. For some reason this New Zealand company has just one director, and he’s in Panama. I hope readers will recognize the smell of that by now. But still, you’d think someone in the NZ registry would be looking out for that sort of thing: it does stick out like a sore thumb; what on earth is the point of registering something like that? How will anyone be able to do the due diligence anyway? It looks remarkably like a front company, just like the bankrupt Swedish one we found before. Another funny thing: it says it’s a Savings and Loan. That’s an extremely strange name for a New Zealand company to give itself, with associations of American financial fraud. Of course if you know nothing about the history of financial fraud, that won’t ring any alarm bells for you. So the sort of person who would do business with a company with a name like that just might be a little naïve. A company name like that is just what a fraudster needs – a filter to keep savvier types away.

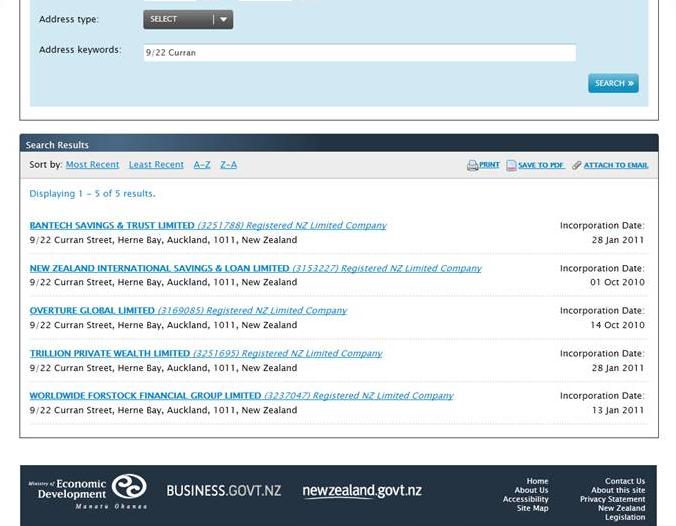

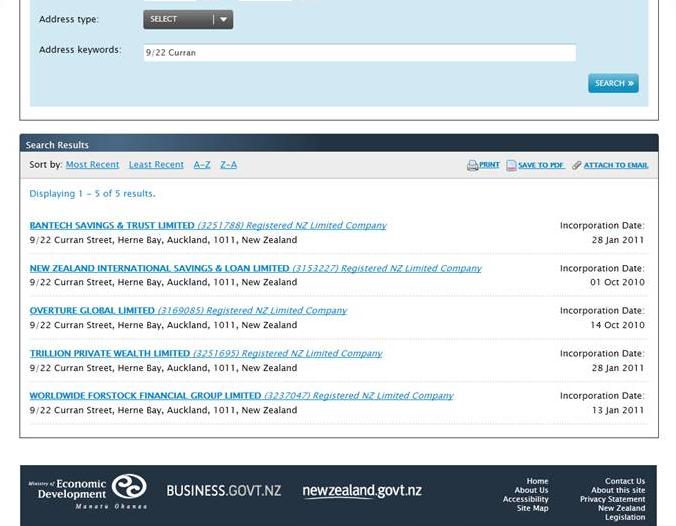

Next let’s do the obvious and let’s see what else we can find at the NZ address “9/22 Curran Street”. Garbage always comes in heaps, doesn’t it? Here’s the heap:

Oops, they all look like a bit like financial services companies, and they’ve all been registered in the last nine months or so. Someone’s brewing up a fraud in New Zealand! Rather than delve into all those front companies (there will be links to unverifiable overseas entities all over the place, no doubt) let’s keep our eyes on two big points:

1. It’s an

offence under NZ’s 1993 Companies Act to make false statements in documents required under the act (such as registration documents).

2. Financial Service Providers (FSPs) have to be registered in New Zealand, at the New Zealand Ministry of Economic Development. And it’s an

offence under NZ’s Financial Service Providers (Registration and Dispute Resolution) Act 2008 to put rubbish on the FSP register.

So that’s OK then, isn’t it? The New Zealand Ministry of Economic Development can be as ineptly trusting as it likes when registering FSPs: the dual deterrents, the Companies Act and the Financial Service Providers act, will deter, won’t they? And besides, the FSP register is protected by New Zealand’s splendid

igovt identity scheme,

which actually makes you input an address when you get an ID. So, as far as the NZ Goverment is concerned, once you have pushed your way past igovt, you are trusted. There’s a spot of extra registration to do when you are registering a financial company, that’s all. You can be an American blogger or a Panamanian crook with a false name or any damn thing you like. Peachy.

And how is all this going, in practice? Not that well, as it happens, as readers who still remember the title of this post will probably have guessed. “Total trainwreck” might be nearer the mark, in fact.

Let’s stick with the first of our garbage companies above, NEW ZEALAND INTERNATIONAL SAVINGS & LOAN LIMITED. Right now it is under the leadership of the Panamanian director, Rodrigo Edgardo ALVARADO, and is owned by a Swedish company, Eurocapital New Zealand Limited Partners SA, Frejgatan 13-882, Stockholm, 11479 , Sweden.

Delving into its brief but already exciting history, we find (01 October 2010 12:14:58) that the guy doing the updates to the company records is Leon QUIJADA, who despite his possibly Panamanian name is apparently resident at 9/22 Curran Street, Herne Bay. That’s

this place, as near as I can make out, or something nearby, and very similar. It doesn’t look much like a nerve centre of international banking. According to the New Company Incorporation, the company was then called NZ GENERAL ADMINISTRATION LIMITED, the director being WOOD, Warwick, also resident at the manifestly capacious 9/22 Curran Street. There is a company name change later.

Next (21 October 2010 09:18:55) it gets another director, our Panamanian Rodrigo Edgardo ALVARADO, but mysteriously translated from Panama to Sweden (Frejgatan 13-882, Stockholm, 11479, SE, again). So at least he gets out and about a bit.

Lastly (27 October 2010 08:49:18) it gets yet another director, Rod ALVAR, likewise resident at 9/22 Curran Street. Warwick WOOD, exhausted by all the comings and goings at 9/22 Curran Street, and the ceaseless registration changes, stands down.

And if you don’t already think the whole of this history is bullshit, something about the name

Rod ALVAR ought to make you pause for thought. Just compare it with the name

Rodrigo Edgardo

ALVARADO. My bet is that at least one (most likely Rod Alvar) of these two characters

doesn’t exist.

All of which means that quite possibly, actual bad people don’t care a bit about the legal penalties for putting dodgy entries on the NZ company registrar (1993 Companies Act). There may be a whole bunch of them doing it already! Or maybe just one guy out in cyberspace somewhere. You just can’t tell.

If I were the NZ police, with no travel budget, and searching for the chimerical Rod Alvar, I’d now be very curious about the denizens of 9/22 Curran Street, and all of the people who’ve left their digital fingerprints on NEW ZEALAND INTERNATIONAL SAVINGS & LOAN LIMITED. And of course, any other company on the register with associations to any of these bods or that address, is tainted.

Happy searching. There will, I suspect, be plenty to find.

Obviously the authentication part of the NZ company registry is utterly hopeless, but that isn’t necessarily all the system designers’ fault. Perhaps, if the security internals of the NZ company registry are as good as its GUI, there will be some logs somewhere that say something useful about where web updates to NEW ZEALAND INTERNATIONAL SAVINGS & LOAN LIMITED actually originate from. Is it Herne Bay, Panama, Stockholm, or somewhere else altogether? Who knows, but it must be worth a quick look.

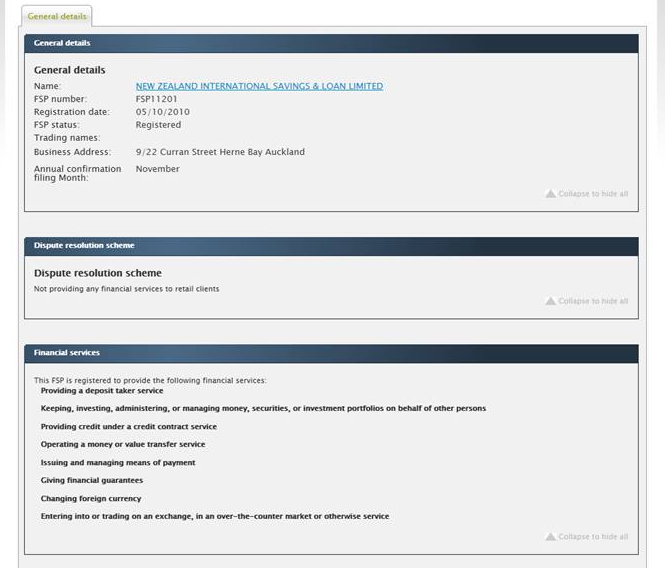

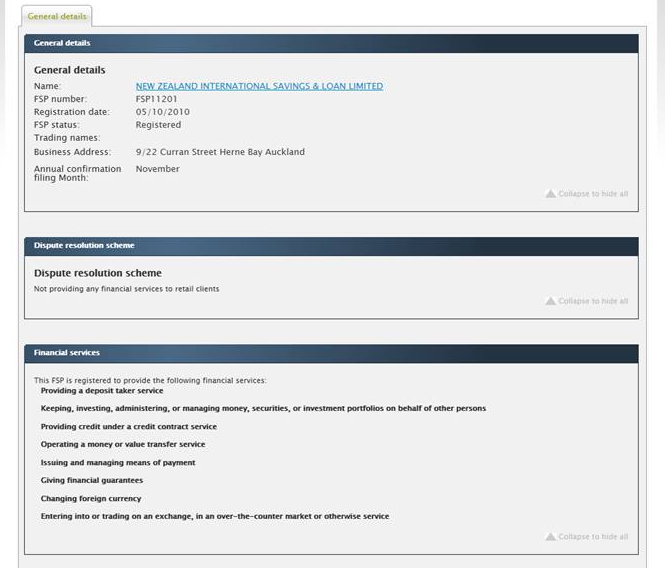

So we have a profoundly dodgy company, NEW ZEALAND INTERNATIONAL SAVINGS & LOAN LIMITED and a profoundly dodgy made-up individual, Rod Alvar, and what look like offences under the 1993 Companies Act. Surely a company that ragged couldn’t possibly make it onto the register of Financial Service Providers, could it? Its mere presence there would make one wonder whether there had been an offence under the Financial Service Providers (Registration and Dispute Resolution) Act 2008, too.

Oh dear; here is its FSP register entry.

Helping to apply a veneer of respectability to dodgy companies, by not monitoring who is registering as an FSP, can only facilitate fraud. Perhaps I am an old fart, but I don’t think the purpose of the New Zealand Ministry of Economic Development’s imprimatur is to facilitate fraud. Of course if the Ministry are actually

aiming at Panama’s “dodgy company” franchise, they should carry on just as they are.

And whoever put that register entry in, brushed igovt aside, too. But then, igovt has been broken ever since the NZ Powers That Be stopped insisting that people wanting an igovt ID had to present themselves at a government office with paper documents. Now you can just lie your head off about who you are, and you still get a login.

Of course, NEW ZEALAND INTERNATIONAL SAVINGS & LOAN LIMITED has a

website. And it’s quite umm…dubious. There are tells aplenty, but what a magnificent one on the main page! NZISL declare:

NZISL offers banking services as a registered Financial Service Provider in New Zealand and not as a registered bank under the supervision of the Reserve Bank in New Zealand. New Zealand International Savings & Loan is regulated by the Ministry of Economy and Finance of New Zealand which is responsible for supervising Financial Service Providers (FSP).

Well, there is no such thing as the “Ministry of Economy and Finance of New Zealand”. FSPs are regulated by the NZ Ministry of Economic Development (via the Companies Office). They’re the folk who registered NZISL as an FSP.

In short, we appear to have the magnificent spectacle of a non-existent financial institution staffed by non-existent people announcing to the world that the Ministry of Economic Development has nothing to do with regulation, and that a fantasy Ministry of their own devising does it instead.

And do you know, I think they might have a point. If this is how closely the Ministry of Economic Development monitor the FSP register, it might as well be like that.

Welcome to the new world of igovt, by the way.

Oh, that’s enough. Here’s a far from exhaustive summary, based on this and other digging. There will be lots more to pull at before the whole furball is extracted. Let’s wrap it into one nice parcel for the various NZ authorities who ought to be interested in all this.

1. The New Zealand company register is in the process of infiltration by Panamanian front companies.

2. The New Zealand Ministry of Economic Development Financial Service Providers register is in the process of infiltration by fraudulent companies.

This will be very bad for its credibility.

3. Given the pace at which these companies are being registered one has to imagine that a rash of attempts to defraud NZ nationals is imminent. Or rather, looking at NZISL, underway.

4. igovt is broken. “igovt means that government service providers can offer you more personalised online services involving more valuable transactions because they have confidence in your identity”, the

igovt site tells us. Until you revert to a guy at a desk checking ID and faces, I’d take it easy with that sort of grand claim, boys, if I were you.

5. The following NZ companies look likely or very likely or dead certs to be frauds or fronts. This might be far from an exhaustive list. One has to stop somewhere.

- Bantec Financial Limited

- Bantec Savings and Trust Limited (FSP 60882, registered end 29 Jan 2011)

- Investment Suisse Depository Savings Loan and Trust Limited

- Investment Suisse Limited (registered mid July 2011, something interesting going on there)

- New Zealand International Savings and Loan Limited (FSP 11201, registered 05 Oct 2010)

- Overture Global Limited

- Pluthero Investment Trust

- Trillion Private Wealth Limited

- Worldwide Forstock Financial Group Limited

6. The following NZ addresses are strongly associated with dodgy NZ companies.

- 48b Bond Street, Auckland 1021

- 9/22 Curran Street Herne Bay Auckland

7. The following names are associated with dodgy NZ companies. It’s possible that none of them refers to a real flesh and blood person.

- KELLY, John, 4556 QLD, Australia (director of Pluthero Investment Trust, Auckland).

- STEWARDS FIDUCIARY SERVICES INC (also owns) of Torre Banistmo, Calle 53,, Marbella, Office 1002,, Panama City, Panama, owns Pluthero Investment Trust

- Timothy Wayne JAMIESON, New Zealand. Director of the NZ company Investment Suisse Limited. Why, of all names, did JAMIESON choose the mongrel English/French “Investment Suisse”, which the internet already associates with scams. JAMIESON comes up in association with 50+ other NZ companies by the way.

- Aknia Mayn CHI PARDO, aka Aknia CHI PARDO, aka Aknia CHI, Panamanian lawyer, director or officer of many front companies in Panama, see above. Director of the NZ company INVESTMENT SUISSE DEPOSITORY SAVINGS LOAN AND TRUST LIMITED.

- Rodrigo Edgardo Alvarado, a Panamanian who registers companies at the NZ registry, perhaps under the alias Rod Alvar, a truncated version of his Panamanian name. He has also changed details for Investment Suisse Limited.

- Mike Hanson, who updates some of the same companies as Rod Alvar.

8. The folk who run the Swedish company register might want to check out how many strange-looking companies they have, too. Perhaps Swedish Lex is in a position to give them a little nudge about dormant companies with overseas directors, especially Panamanian directors. Or they might start with the address Frejgatan 13-882, Stockholm, 11479.

9. This is farcical. If, against all the evidence I have accumulated, there really are any NZ authorities who do happen to be mildly interested in preventing their country becoming a one stop shop for financial fraudsters, and who don’t want to just sit and wait for a boatload of fraud cases to hit the headlines, I have more info, and can be contacted via

yves@nakedcapitalism.com.

![[depression2]](http://si.wsj.net/public/resources/images/OB-OZ182_depres_DV_20110729182738.jpg) Getty Images

Getty Images

![[depression1]](http://si.wsj.net/public/resources/images/OB-OZ180_depres_DV_20110729182649.jpg) Getty Images

Getty Images ![[depression23]](http://si.wsj.net/public/resources/images/OB-OZ184_depres_DV_20110729182826.jpg) Getty Images

Getty Images ![[depression4]](http://si.wsj.net/public/resources/images/OB-OZ185_depres_DV_20110729182925.jpg) Getty Images

Getty Images