Why the Obama tax deal with Republicans is insane

Cross posted from Real Economics.

The central premise of U.S. economic policy since the election of Ronald Reagan in 1980 has been that the people in the private sector who know how to invest – the rich – do a much better job allocating society’s financial resources than the federal government. In fact, Reagan told us in his first inaugural address, “government is the problem."

In order to get as much of society’s financial resources into the hands of the rich - the people in the private sector who supposedly would do a better job investing it - Reagan, the Republican Party, and American conservatives in general developed a simple-minded faith in tax cuts, especially in reducing taxes on the highest incomes.

What are the results of this thirty year experiment low taxes? The Reagan / Republican / conservative theory DOES NOT WORK. For the first time in American history, we now have a generation that has less education and worse economic prospects than their parents did thirty years ago.

In all the hub-bub and brou-hah-hah of the tax debate the past few days, weeks, and months, hardly anyone has put forward the clear and unambiguous information that

TAX

CUTS

DO

NOT

WORK.

In fact, there have been three grand multi-year national experiments with Republican / Conservative tax cutting over the past century. And all three experiments resulted in the average American becoming poorer, the real (industraal) economy in tatters, and spectacular financial crashes.

tax cutting over the past century. And all three experiments resulted in the average American becoming poorer, the real (industraal) economy in tatters, and spectacular financial crashes.

Tax Cut Experiment Number 1

In 1921, President Warren G. Harding proposed ending the wartime excess profits tax which had been imposed during World War I. Calvin Coolidge followed Harding into the White House in 1923. Coolidge was launched to national prominence when as Governor of Massachusetts, he mobilized the state’s National Guard in September 1919, to crush a strike of three quarters of the policemen of the Boston Police Department , who were trying to force official acceptance of their membership in, and representation by, the American Federation of Labor.

, who were trying to force official acceptance of their membership in, and representation by, the American Federation of Labor.

Coolidge, you may recall, was “rehabilitated” during Ronald Reagan’s (who broke the air traffic controllers' union) term as President. Coolidge’s brutal suppression of the Boston strikers, and his sharply worded rebuke to AFL president Samuel Gompers, led Harding to select him as vice president. So, when Harding died during a speaking tour in California in August 1923, Coolidge became President, and it was Silent Cal who actually signed into law the Revenue Act of 1924, which lowered personal income tax rates on the highest incomes from 73 percent to 46 percent.

Two years later, the Revenue Act of 1926 law further reduced inheritance and personal income taxes; eliminated many excise imposts (luxury or nuisance taxes); and ended public access to federal income tax returns. The tax rate on the highest incomes was reduced to 25 percent.

What resulted was the building up of a speculative frenzy in the stock markets, especially with the application of structured leverage in what were called at that time "investment trusts." In September 1929, this edifice of false prosperity began to wobble, and ended in October 1929 with the stock market crash.

Republican President Herbert Hoover (Coolidge did not seek re-nomination in 1928) responded with more tax cuts! Personal income tax on income under $4,000 was cut by two thirds; personal income tax on income over $4,000 was cut in half. The tax rate on corporations was cut by a full percentage point.

How did the economy respond to these tax cuts? It sunk further into the First Great Depression.

Tax Cut Experiment Number 2

In 1981, Reagan significantly reduced the top marginal tax rate, which affects the very wealthy, a from 70% to 50%; in 1986 he further reduced the rate to 28%. Contrary to the Reagan / Republican / conservative argument that the tax cuts would pay for themselves by boosting economic activity the budget deficit and federal debt exploded. Federal government debt grew from 33.3% of GDP in 1980 to 51.9% at the end of 1988.

Meanwhile, the average American family began working more hours just to keep place. The phenomena of latch-key kids took hold as mothers sought jobs to help keep their family afloat. Wikipedia notes that the number of Americans below the poverty level increased from 29.272 million in 1980 to 31.745 million in 1988, which means that, as a percentage of the total population, it remained almost stationary, from 12.95% in 1980 to 13% in 1988. The poverty level for people under the age of 18 increased from 11.543 million in 1980 (18.3% of all child population) to 12.455 (19.5%) in 1988.

Reagan's tax cuts failed to revive American industry, which was also being hammered by the Reagan / Republican / conservative blind faith in free trade.A number of American industries actually disappeared. By the end of Reagan’s presidency, the American textile, apparel, and footwear making industries had been reduced to less than one tenth the size and sales they had been just two decades before. During Reagan’s tenure, the U.S. lost its trade surplus in consumer electronics, and began to also lose its advantage in industrial electronics. The most important industry of all, the machine tool industry - which is needed to make all other production equipment - slipped into a death spiral from which it has never recovered. Steel, auto, printing equipment, construction equipment, farm equipment, power generating equipment – in industry after industry, under Reagan, the U.S. began to lose its world lead.

Only the aerospace industry, the key component of the American empire’s military-industrial complex, managed to maintain its world lead. Oh, and the banking and financial sector. But in October 1987, the worst stock market crash since the First Great Depression shook Wall Street.

Tax Cut Experiment Number 3

Republicans and conservatives of course contend that the two Bush tax cuts created the economic boom of 2002-2006. But Wikipedia notes the following, rarely discussed, facts:

A significant driver of economic growth during the Bush administration was home equity extraction, in essence borrowing against the value of the home to finance personal consumption. Free cash used by consumers from equity extraction doubled from $627 billion in 2001 to $1,428 billion in 2005 as the housing bubble built, a total of nearly $5 trillion dollars over the period. Using the home as a source of funds also reduced the net savings rate significantly. By comparison, GDP grew by approximately $2.3 trillion during the same 2001-2005 period in current dollars, from $10.1 to $12.4 trillion.

Economist Paul Krugman wrote in 2009: "The prosperity of a few years ago, such as it was — profits were terrific, wages not so much — depended on a huge bubble in housing, which replaced an earlier huge bubble in stocks. And since the housing bubble isn’t coming back, the spending that sustained the economy in the pre-crisis years isn’t coming back either." Niall Ferguson stated that excluding the effect of home equity extraction, the U.S. economy grew at a 1% rate during the Bush years.

The amount of money Americans took out of their bubbling home equity was more than double the increase in GDP under Bush. Meanwhile, U.S. industries continued to weaken and falter. Even the semiconductor and computer industries - once the crown jewels of the American industrial economy - basically collapsed under Bush, fleeing offshore. As Andy Grove, one of the founders and former chairman of semiconductor pioneer Intel wrote back in early July (How to Make an American Job Before It's Too Late):

Today, manufacturing employment in the U.S. computer industry is about 166,000 -- lower than it was before the first personal computer, the MITS Altair 2800, was assembled in 1975. Meanwhile, a very effective computer-manufacturing industry has emerged in Asia, employing about 1.5 million workers -- factory employees, engineers and managers.

The largest of these companies is Hon Hai Precision Industry Co., also known as Foxconn. The company has grown at an astounding rate, first in Taiwan and later in China. Its revenue last year was $62 billion, larger than Apple Inc., Microsoft Corp., Dell Inc. or Intel. Foxconn employs more than 800,000 people, more than the combined worldwide head count of Apple, Dell, Microsoft, Hewlett-Packard Co., Intel and Sony Corp.

Most important to note, wages and earnings for all but the richest Americans continued to stagnate, and actually declined for the bottom quintile of wage earners.

And, in late 2006, the sub-prime mortgage crisis began to unravel the very fabric of the world financial system, leading to the crashes of April and September 2008.

The failure of our national debate on tax cuts

Most discouraging about this entire national debate on taxes, has been the complete failure of President Obama and the Democratic leadership to point to these clear facts, and ask - and answer - the obvious question:

Why do tax cuts lead, counter-intuitively, to industrial decline, stagnant wages, and finally financial collapse?

The fact is that high marginal tax rates strongly correlate with economic growth. As Mike Kimel wrote yesterday on Angry Bear:

But perhaps it is unfair to compare Reagan to big-government types like Lyndon Johnson or Roosevelt, as they served during very different eras. Focusing instead on more recent periods, real GDP also grew faster under Bill Clinton, who raised taxes, than it did under Ronald Reagan. In fact, from 1981 to the present, the period in which Reagan’s philosophies have reigned triumphant, the correlation between the top marginal tax rate and the annual growth in real GDP has been positive. That is to say, higher top marginal tax rates have been associated with faster, not slower real economic growth. Conversely, lower top marginal tax rates have coincided with less economic growth.

The positive relationship between the top [higher] marginal tax rate and the growth in real GDP is very nearly bullet-proof. For instance, it extends all the way back to 1929, the first year for which the government computed GDP data. Additionally, higher marginal tax rates are not only correlated with faster increases in real GDP from one year to the next, but also with increases in real GDP over the subsequent two, three, or four years. This is as true going back to 1929 as it is for the period since Reagan became president. In fact, since the Reagan Revolution took hold, similar relationships have existed between the top marginal rate and several other important variables, like real median income, real private investment, consumer sentiment, the value of the dollar relative to other major currencies, and the S&P 500. Lower tax rates in any given year are associated with slower growth rates for each of these variables, whether those growth rates are measured over periods of one, two, three or four years.

If you look under the hood of the industrial economy, you easily see why there is this counter-intuitive relationship between tax rates and economic growth . With high taxes, the only way to retain the bulk of the wealth created by a business is by reinvesting it in the business -- in plants, equipment, staff, research and development, new products and all the rest. But if tax rates are low, then there is more incentive to pull the wealth out, by declaring it as profits that are taxed at what turns out to be too low a rate. In other words, low taxes create an incentive for profit taking.

This in turn creates an incentive for short-term horizons in business planning. If you’re going to be taking all the profits out of a company, and take home a few million a year, why bother to reinvest anything in the business? You’re going to be rich, and never have to work again, even if the business goes bust. Or gets packed on a boat and shipped to China. Or goes “virtual” and lets all the hard work, like, you know, actually making something, be done by the lowest bidder. Employees? Don’t need them.

But employees are also customers. If enough businesses “take profits”, after some length of time, the former employees also become former customers. Meaning, they stop buying. The economy's aggregate demand generation is crippled. From the three Republican tax cut experiments this past century, it appears the length of time for this to happen is five to seven years.

If tax rates are high enough to discourage profit taking - forcing wealth created by a business to be recycled back into the business – then businesses are pushed toward longer-term planning, as they invest in new plant and equipment that will be used for many years. And you do not get the absurd situation you have now, where companies are posting record breaking profits, but are not buying new equipment, nor hiring new employees.

Low tax rates encourage taking wealth out of industrial companies; the wealth taken out must then be “put to work.” That means more money chasing “investment” opportunities, leading to price increases in financial capital or real estate or some other asset. In other words, an asset bubble. The rise in prices of an asset bubble has nothing to do with the creation of real wealth. It all looks like prosperity – until the asset bubble bursts. That’s where we are now.

Tax cuts only work to build bubbles that enrich mostly the financial sector. Tax cuts do nothing to help the real, industrial economy. The rich of America have proven that they are not very good at investing: they prefer credit default swaps over investing in sustainable energy start-ups. The major economic challenge of the past three decades has been to create a new economy that is not dependent on burning fossil fuels. The Reagan / Republican / conservative theory that the rich are best at allocating our society's financial resources has been a disastrous failure. We have wasted thirty years testing their theory. It's time to force elites to admit that it does not work.

The virtuous economic cycle that was destroyed by Reagan

Another reason tax cuts do not create economic growth has to do with the distribution of income in the economy. The Republican / conservative religious belief that “tax cuts create jobs” has become so shallow and so insipid, that they don’t even understand the actual process of job creation contained in their own lousy theory. Tax cuts do NOT create jobs. It is the response of business to growth of aggregate demand in the economy that creates jobs.

So, will the tax cuts of this new Obama / Republican / conservative deal boost aggregate demand?

A bit, maybe, but not as much as direct spending on infrastructure would.

Dave Johnson explained the essential problem of the flawed economic assumptions of the thinking behind the Obama / Republican / conservative deal back in August:

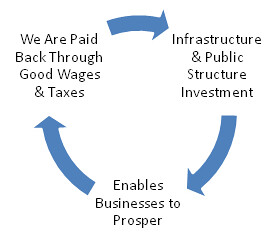

The American Social Contract is supposed to work like this:

A beneficial cycle: We invest in infrastructure and public structures that create the conditions for enterprise to form and prosper. We prepare the ground for business to thrive. When enterprise prospers we share the bounty, with good wages and benefits for the people who work in the businesses and taxes that provide for the general welfare and for reinvestment in the infrastructure and public structures that keep the system going.

We fought hard to develop this system and it worked for us. We, the People fought and built our government to empower and protect us providing social services for the general welfare. We, through our government built up infrastructure and public structures like courts, laws, schools, roads, bridges. That investment creates the conditions that enable commerce to prosper – the bounty of democracy. In return we ask those who benefit most from the enterprise we enabled to share the return on our investment with all of us – through good wages, benefits and taxes.

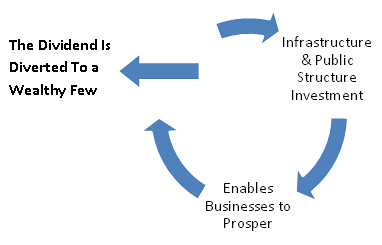

But the "Reagan Revolution" broke the contract. Since Reagan the system is working like this:

Since the Reagan Revolution with its tax cuts for the rich, its anti-government policies, and itsderegulation of the big corporations our democracy is increasingly defunded (and that was the plan), infrastructure is crumbling, our schools are falling behind, factories and supply chains are being dismantled, those still at work are working longer hours for fewer benefits and falling wages, our pensions are gone, wealth and income are increasing concentrating at the very top, our country is declining.

This is the Reagan Revolution home to roost: the social contract is broken. Instead of providing good wages and benefits and paying taxes to provide for the general welfare and reinvestment in infrastructure and public structures, the bounty of our democracy is being diverted to a wealthy few.

So, the idea that these tax cuts will help get boost the economic recovery just when President Obama is campaigning for re-election, is absurd. In fact, Ian Welsh, who has been eerily prescient about economic and political developments in the U.S. the past few years, guarantees that this deal will NOT help the economy

The past 30 years, and the past 10 years in particular, have been a huge experiment in tax-cutting, and for ordinary people, the result has been stagnation and now an absolute decline. Because ordinary people do not have pricing power, either as workers for their labor (since there are plenty of people who need jobs) or as consumers (because the oligopolies who sell food, energy, telecom and so on know you must have their services) every single red cent of tax cuts which go to the middle and lower class will be taken away by corporations and the rich. Those corporations and rich will then use that money to either play leveraged financial games or to offshore jobs to low cost, low regulation domiciles. Not only do tax cuts not do any good, they accelerate the loss of US jobs. No, this isn’t what you’ve been told, indeed propagandized, for the last thirty years. But how has trickle down economics worked out for you? Are you going to believe your lying eyes, or the talking heads who tell you that tax cuts create jobs?

The sane alternative: tax the financial system

Proof that both parties are controlled by a single financial oligarchy – or, as OnePissedOffLibeal proposes, there’s no use blaming President Obama - is that the single best solution is missing from the national discussion. A tax of just one fifth of one percent on all financial market transactions – stocks, bonds, futures, currency forex, options, swaps, and other derivatives - would raise nearly one trillion dollars in the first year, because of the sheer volume of trading. But such a tax would rapidly shrink the volume of trading, so the few economists, like Dean Baker, who have worked the numbers stick with a figure of around $200 billion a year.

In the 1960s, all the trading in all the financial markets amounted to about one and one half times the U.S. annual gross domestic product. Today, the trading of all the stocks, bonds, futures, foreign exchange, and other financial instruments amounts to over fifty times U.S. GDP, or around three trillion dollars a day in the U.S.

Above from the Wikipedia article on Financialization

How much does it cost our economy to move around this much financial paper each and every day? Let us assume that the fees, commissions, and so on paid to the financial system for all this frenetic activity amount to one percent. (An October 2003 study conducted by John P. Hussman, President of Hussman Investment Trust, found that the costs to the funds he manages actually amounted to approximately 1.87%; scroll down to the bottom.)

So, one percent of three trillion a day is $30 billion in commissions / fees / bonuses, etc., paid to the financial system for all that paper being shoved around. $30 billion a day going to the financial system in fees and commissions? Couldn’t that be used instead to pay 600,000 (six hundred thousand) jobs paying $50,000 a year?

Taken ten days of trading away from the financial markets, and we can pay for six million jobs. Six. Million. Jobs.

This is how the financial system sucks the life blood out of the economy. This is where we so desperately need the change Obama promised - a promise it now appears, was merely a campaign slogan. But, as Stirling Newberry noted in March 2009:

The more conservative thinkers are appalled at the idea that the monetary order that emerged post-collapse of Bretton Woods might be attacked, because living off of dipping a small cup in the Niagra Falls of finance is the only world they have ever known. . .

The need to increase the volume of financial trading was the basic driver of securitization of home mortgages, and the development and proliferation of financial derivatives. This level of financial trading, and the toll it exacts on the rest of the economy, is nothing less than a plague of usury of Biblical proportions. Until the financial system is cut down to size, there can NOT be any economic recovery for the rest of us. It is basic economics that when you have too much of socially destructive activity, you should tax it - heavily.

Why is it that no one – NO ONE – among our elites, including even Paul Krugman, ever push for a tax on financial market transactions?

Cui bono?

Why has the entire national debate been so devoid of these facts? Why are certain things, such as the insane level of trading in the financial markets, never discussed?

To answer those questions, simply ask:

Who benefits?

No comments:

Post a Comment