Posted: 08 Jan 2012 11:43 PM PST

Adam Davidson has an article in the Sunday New York Times Magazine, “The Other Reason Europe is Going Broke,” that manages the impressive feat of making you stupider than before you read it. It misrepresents most of the few facts it contains in appealing to American prejudices about our cultural, or in this case, economics superiority, to sell worker bashing. Davidson uses the spectacle of Europe going into an economic nosedive to claim that one of the big things wrong with Europe is its spoiled workers. The piece is anchored in a glaring, fundamental misrepresentation. It argues that Americans are much better off than Europeans because we have a higher GDP per capita (more on that in due course) and asserts that that is because Europeans are not able to compete in world markets:

After decades of trying, Europe as a whole still can’t quite figure out how to be flexible enough to compete in the global economy.The basis for Europe’s supposed failure compared to the supposedly more flexible and innovative US? That its trade with the rest of the world is more or less in balance. By that standard, the US is a abject failure from a competitive standpoint, since we’ve run sustained trade deficits since the early 1980s (with a brief period of a surplus in the early 1990s). So by Davidson’s standard of competitiveness, the US is an abject failure, particularly since the euro has risen against the dollar since 2001 (and even with its recent fall is still well above that level).

And even though Davidson presents himself as a messenger, he clearly sides with this anti-worker paradigm:

It’s a core view of U.S. business that success requires a degree of destruction. If workers can’t be fired, companies can’t drop unproductive businesses and invest in more promising new ones. If workers know they’ll get generous government benefits no matter what, so the theory goes, they’ll get lazy.Funny, German managers actually prefer a system that allows them to maintain staff levels at reduced pay when the economy is weak. And anyone who has managed an operation, as opposed to a soi-disant economist, will tell you that hiring new staff is a painful exercise: the interviews, the initial period when they are less productive (this is not just a matter of job skill; every business has certain idiosyncrasies that a new employee must learn). And firing people is no party either, and it distracts and demoralizes their peers. And the conventional view that European productivity gains lagged those of the US starting in 1995 is increasingly questioned. From Paul Krugman in 2009:

I went back to something that was a hot topic not long ago, and will be again if and when the crisis ends: the apparent lag of European productivity since 1995…I noticed something that gave me pause.Now let’s get to the GDP per head part. The notion that GDP is all that it is cracked up to be as a measure of economic prosperity is challenged in another article in the New York Times over the weekend, “The Myth of Japan’s Failure” (hat tip reader Scott):

In their paper, van Ark etc. identify the service sector as the main source of America’s pullaway — which is the standard argument. Within services, roughly half they attribute to distribution — roughly speaking, the Wal-Mart effect. OK.

But the other half is a surge in US productivity in financial and business services, not matched in Europe. And all I can say is, whoa!

First of all, how do we even measure output of financial services? If I read this BEA paper correctly, we more or less use “checks cashed” — or, more broadly, the number of transactions undertaken. This may be the best we can do, but it’s a pretty weak measure of actual work done by the financial system.

And given recent events, are we even sure that the expansion of the financial system was doing anything productive at all?

In short, how much of the apparent US productivity miracle, a miracle not shared by Europe, was a statistical illusion created by our bloated finance industry?

Dean Baker has argued for some time that, properly measured, the productivity gap between America and Europe never happened. I’m becoming more sympathetic to his point of view.

There are a number of facts and figures that don’t quite square with Japan’s image as the laughingstock of the business pages:Frankly, I have been hearing from the mid 1990s onwards that things in Japan were no where near as bad as depicted in the Western press. And from the most savvy Japan watchers (as in people who have lived there during this period), the view I hear most often is that it was to Japan’s advantage to depict itself as a basket case, so the US would not press for a stronger yen (remember, Japan is a military protectorate of the US, so we actually can push it around from time to time. For example, during the 1987 crash, the Treasury market became wobbly, and the Fed called the Bank of Japan and told it to buy Treasuries. The BoJ called banks like my then employer Sumitomo, who fell into line).

• Japan’s average life expectancy at birth grew by 4.2 years — to 83 years from 78.8 years — between 1989 and 2009. This means the Japanese now typically live 4.8 years longer than Americans. The progress, moreover, was achieved in spite of, rather than because of, diet. The Japanese people are eating more Western food than ever. The key driver has been better health care.William J. Holstein, a prominent Japan watcher since the early 1980s, recently visited the country for the first time in some years. “There’s a dramatic gap between what one reads in the United States and what one sees on the ground in Japan,” he said. “The Japanese are dressed better than Americans. They have the latest cars, including Porsches, Audis, Mercedes-Benzes and all the finest models. I have never seen so many spoiled pets. And the physical infrastructure of the country keeps improving and evolving.”

• Japan has made remarkable strides in Internet infrastructure. Although as late as the mid-1990s it was ridiculed as lagging, it has now turned the tables. In a recent survey by Akamai Technologies, of the 50 cities in the world with the fastest Internet service, 38 were in Japan, compared to only 3 in the United States…

• The unemployment rate is 4.2 percent, about half of that in the United States.

• According to skyscraperpage.com, a Web site that tracks major buildings around the world, 81 high-rise buildings taller than 500 feet have been constructed in Tokyo since the “lost decades” began. That compares with 64 in New York, 48 in Chicago, and 7 in Los Angeles…

But the most important tidbit is later in the article, and it touches on hedonic adjustments to GDP, a topic that is not often discussed in polite company. We’ve covered this in greater depth before, for instance, in this 2007 post:

Let’s look at GDP. That’s a fundamental figure, surely beyond question or compromise. Really? Our GDP stats include something called a “hedonic price index” basically to allow for the fact that computers are becoming more powerful at lower costs. In essence, the US grosses up the price of computers in its GDP reports to adjust for the fact that computer prices are dropping.

These adjustments are significant. The US is the only country that uses hedonic indexing. The Bundesbank complained that if they calculated GDP the way we did, their GDP growth would be 0.5% higher. And the cumulative distortion is massive. In 2005, Michael Shedlock contacted the Bureau of Economic Advisers and they supplied some dated information on hedonics (including a spreadsheet). Even so, he found that hedonic adjustment to GDP was 2.257 TRILLION dollars, or 22% of then-current GDP.

And now let’s get to the kicker. Here is how Davidson characterized the US versus Europe, at the top of his piece:

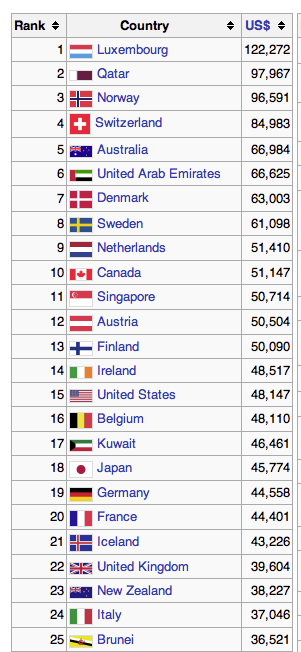

But G.D.P. per capita (an insufficient indicator, but one most economists use) in the U.S. is nearly 50 percent higher than it is in Europe. Even Europe’s best-performing large country, Germany, is about 20 percent poorer than the U.S. on a per-person basis (and both countries have roughly 15 percent of their populations living below the poverty line). While Norway and Sweden are richer than the U.S., on average, they are more comparable to wealthy American microeconomies like Washington, D.C., or parts of Connecticut — both of which are actually considerably wealthier.The IMF reported these per capita GDP figure for 2011, per Wikipedia, in the World Economic Outlook Database-September 2011. Davidson apparently chose another source, possibly the World Bank or the CIA Factbook, which puts the US higher in the relative rankiing:

And even before you make a roughly 20% adjustment to US GDP that the hedonic indexing hocus pocus suggests might be in order.

It seems difficult to fathom how anyone could argue for squeezing labor when Europe is a living laboratory in how it simply produces a downward spiral. It was the right remedy when inflation was rampant, but that ceased being a pressing worry over two decades ago. It is now a useful canard to facilitate transfers from ordinary workers to top management, and it appears there is no shortage of propagandists like Davidson to carry the message.

No comments:

Post a Comment