Posted: 06 Dec 2011 12:26 AM PST

By Andrew Dittmer, who recently finished his PhD in mathematics at Harvard and is currently continuing work on his thesis topic. He also taught mathematics at a local elementary school. Andrew enjoys explaining the recent history of the financial sector to a popular audience.

Simulposted at The Distributist Review

This is the sixth and final installment of an interview series. For the previous parts, see Part 1, Part 2, Part 3, Part 4 and Part 5. Red indicates exact quotes from Hans-Hermann Hoppe’s 2001 book “Democracy: The God That Failed.”

ANDREW: You’ve explained to me how in the libertarian society of the future, everyone will be free and their rights will not be violated. However, many people will be coerced in a noncoercive way, and a lot of people will be effectively slaves in a rights-respecting manner. Some people will be effectively killed in a rights-respecting manner. Why are you dedicating your life to making this society possible?

CODE NAME CAIN: I really take issue with the way you describe things. You twist words so that “freedom” and “rights” end up sounding like they are not always good things.

ANDREW: Can you just answer the question?

CNC: If you insist – but it will be a complicated discussion. To begin, [t]he natural outcome of the voluntary transactions between… private property owners is decidedly nonegalitarian, hierarchical, and elitist [71]. After all, the “permanently” rich and the “permanently” poor are usually rich or poor for a reason. The rich are characteristically bright and industrious, and the poor typically dull, lazy, or both. [96-97]

ANDREW: You talk almost as if lower-class people were so different from productive geniuses that they form a separate subspecies.

CNC: Well, there is something to that. As Edward Banfield says in The Unheavenly City, “if [the lower-class individual] has any awareness of the future, it is of something fixed, fated, beyond his control: things happen to him, he does not make them happen. Impulse governs his behavior, either because he cannot discipline himself to sacrifice a present for a future satisfaction or because he has no sense of the future.” Thus “permanent” poverty… is caused by… a person’s present-orientedness… (which is highly correlated with low intelligence, and both of which appear to have a common genetic basis) [97].

ANDREW: Are these ideas related to your criticism of democracy?

CNC: In a democracy, a politician understands that bums and inferior people will likely support his egalitarian policies, whereas geniuses and superior people will not. [145] For [this] reason… a democratic ruler undertakes little to actively expel those people whose presence within the country constitutes a negative externality (human trash which drives individual property values down). [145]

Therefore democratic rulers tend to subsidize bums, and every subsidy always produces more of the behavior subsidized – whether good or bad. By subsidizing with tax funds (with funds taken from others) people who are poor (bad), more poverty will be created. By subsidizing people because they are unemployed (bad), more unemployment will be created. [195] As a result of subsidizing… the careless, …the drug addicts, the Aids-infected, and the physically and mentally “challenged” though insurance regulation and compulsory health insurance, there will be more… carelessness, …drug addiction, Aids infection, and physical and mental retardation. [99]

Thus we see that the welfare state promotes the proliferation of intellectually and morally inferior people, and the results would be even worse were it not for the fact that crime rates are particularly high among these people, and that they tend to eliminate each other more frequently. [185]

ANDREW: I bet you even have scientific “studies” backing up these conclusions.

CNC: Yes, research bears out my claims. Take Banfield’s The Unheavenly City, or Murray and Herrnstein’s The Bell Curve, or Seymour Itzkoff’s The Decline of Intelligence in America. Have you read them?

ANDREW: No.

CNC: Will you?

ANDREW: Maybe. The Unheavenly City at least looks entertaining, whereas The Bell Curve looks long and boring.

CNC: If you read them from an unbiased point of view and you are persuaded that many lower class people are intellectually degenerate, will you change your views on democracy?

ANDREW: No. I expect that the arguments will be full of holes, but even if I can’t find any obvious flaws in the logic, I will still treat people who live in the projects as if they are human beings in the full sense of the word.

CNC: See? This is a classic case of evading ideas that threaten your personal world view. You have a quasi-religious attachment to the idea that all human beings have some sort of metaphysical “spark” or “spirit” that gives them value, and that leads you to close your mind and refuse to take an unbiased look at unorthodox viewpoints.

ANDREW: You see yourself, instead, as understanding the world through logical deductions from objective facts and data.

CNC: No. The problem is that [t]he data of history are logically compatible with… rival interpretations, and historians… have no way of deciding in favor of one or the other [xv]. We may agree… that feudal Europe was poor, that monarchical Europe was wealthier, and that democratic Europe is wealthier still… Yet was Europe poor because of feudalism, and did it grow richer because of monarchy and democracy? Or did Europe grow richer in spite of monarchy and democracy? [Rockwell overview] But there is a way out of this impasse.

The key is to rely upon a priori theory, i.e., propositions which assert something about reality and can be validated independent of the outcome of any future experience [xv]. Examples of such propositions include: No two lines can enclose a space. Whatever object is red all over cannot be green… all over… 4=3+1…. A priori theory trumps and corrects experience (and logic overrules observation), and not vice-versa. [xvi] This procedure is what Ludwig von Mises called praxeology.

ANDREW: This is fascinating.

CNC: What is more, praxeology includes similarly definitive propositions that are valid in the social sciences. For instance, a larger quantity of a good is preferred to a smaller amount of the same good; … an increase in the supply of paper money cannot increase total social wealth … Taxes… reduce production and/or wealth below what it otherwise would have been. [xvii, Rockwell]

ANDREW: So if someone does a study that shows that the Fed increased the money supply and the economy prospered, then…

CNC: Then since an increase in the paper money supply cannot lead to greater prosperity [Rockwell], we can be praxeologically certain that any increase in prosperity took place despite the increase in the money supply. Similarly, the improvement in living standards from the feudal period until today must have occurred in spite of democracy, not because of democracy.

ANDREW: How is praxeology viewed in the academic world?

CNC: Many reactions are dismissive. However, although mainstream economists refuse to recognize their debt to Mises, I am personally convinced that many of them are closet praxeologists.

ANDREW: Can you demonstrate for us how praxeology works? For instance, can you praxeologically prove to us that government regulation is always bad for the economy?

CNC: Of course – but you’ll have to conquer your math phobia and be willing to study a couple of graphs.

ANDREW: I guess I can make the effort, if it’s essential to the explanation.

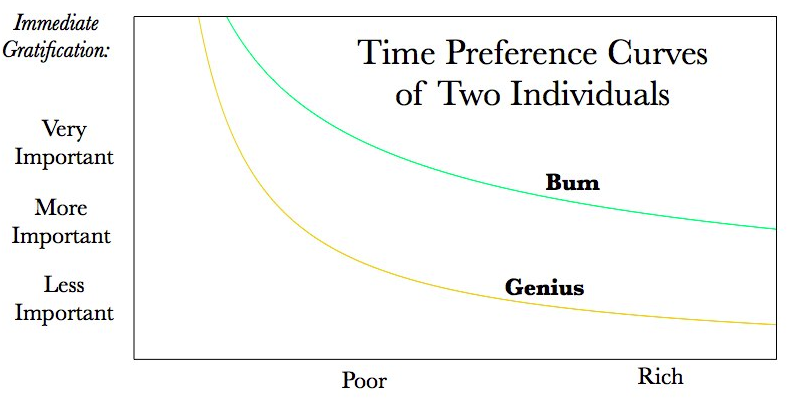

CNC: Then let’s begin. Consider the following two time preference graphs. In both graphs, as the person gets richer, the person is more likely to be focused on the future and not just on immediate gratification.

The green curve represents a person (for example, an uncivilized man or a bum) who, even if rich, still may not care about anything but the present and the most immediate future. Like a child, he may only be interested in… minimally delayed gratification. In accordance with his high time preference, he may want to be a vagabond, a drifter, a drunkard, a junkie, a daydreamer, or simply a happy-go-lucky kind of guy who likes to work as little as possible in order to enjoy each and every day to the fullest. [5]

On the other hand, the gold curve represents a more mature person (for example, a productive genius) who, even when poor, does not merely focus on the present moment, but instead worr[ies] about his and his offspring’s future constantly [5].

Now I can explain why government regulation always reduces living standards. First of all, if a society is future-oriented (like the productive genius), then it will prosper. If it is focused on immediate gratification (like the bum), then it will stagnate. Time preference (whether someone is exclusively focused on the present moment, or whether they also consider the future) is the key factor that determines which societies succeed.

ANDREW: Being future-oriented is the only thing that matters? It doesn’t matter whether a country has honest people, or the freedom to discuss new ideas?

CNC: Respect for property rights inevitably leads to a culture of integrity, so your point is irrelevant. Returning to the subject, when you add government regulation to the picture, there are two effects. First, regulation interferes with private property rights. That effectively reduces people’s wealth. That makes people poorer. Poorer people are more needy, and so they are more focused on where their next meal is coming from. In other words, they are more focused on instant gratification.

ANDREW: How does the government telling a garbage company that it can’t dump toxic sludge in a river make the people in the country more focused on instant gratification?

CNC: Stop interrupting – you might learn something. The second way that regulation destroys prosperity is also important. When the government regulates people, they know that their property rights have been violated – and they also know that the government might violate their rights in the future – but they don’t know when those future rights violations will occur! So their uncertainty increases. They respond by associating a permanently higher risk with all future production [14] and become more focused on immediate gratification.

ANDREW: Suppose bank examiners go around and make sure that banks are not making dangerous or illegal loans with depositors’ money. How does this make depositors more uncertain about the future? How does this make banks more uncertain about the trustworthiness of other banks?

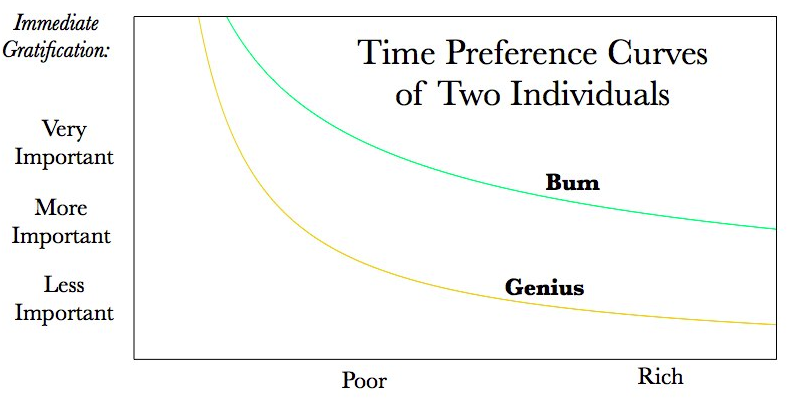

CNC: If you are sincerely interested in understanding the answers to those questions, you can always pick up an economics textbook. Anyway, we can elegantly sum up both of these effects of regulation in the following graph:

The first effect makes productive geniuses poorer, and so causes their time preference to rise along the gold curve, from point X to point Y. The second effect makes productive geniuses more focused on immediate gratification and so causes them to act more like bums. In other words, it leads to a rise in time preference schedules, moving from point Y on the gold curve to point Z on the green curve. The rise in time preference rates from Z to X means the society has become much more focused on instant gratification – and this rise is directly traceable to the pernicious effects of government regulation. With this rise in time-preference, the progress of civilization slows, and may even go into reverse: formerly provident providers will be turned into drunks or daydreamers, adults into children, civilized men into barbarians, and producers into criminals [15].

ANDREW: Your argument is not very convincing. It is built out of a series of assertions, and none of the assertions makes sense. The argument with the graphs is exactly the same, but with graphs.

CNC: When I argue by citing scientific evidence, you refuse to consider it. When I argue praxeologically, and produce a chain of logic that compels assent, you claim to be unable to understand the reasoning. Still, I will try one more time. If logic is difficult for you, why don’t I illustrate my point through a story?

ANDREW: Why not?

CNC: Once upon a time, there was a certain man, and he had two sons. The older son stayed at home and worked hard and did whatever his father wanted. But the younger son got bored of life at home, and asked for his portion of the inheritance. The father consented, and the younger son left. He took a journey into a far country, and there wasted his money in riotous living.

The younger son became hungry, and in order to survive, he took a job feeding hogs. But he still did not have enough food to eat, and decided to return to his father.

And he arose, and came to his father. But when he was yet a great way off, his father saw him, and had compassion, and ran, and fell on his neck, and kissed him. And the son said unto him, “Father, I have sinned against heaven, and before thee, and am no more worthy to be called thy son: make me one of thy hired servants.”

But the father said to his servants, “Bring forth the best robe, and put it on him; and put a ring on his hand, and shoes on his feet. And bring the fatted calf, and kill it; and let us eat, and be merry.”

Now the older son was in the field, and as he came and drew nigh to the house, he heard music and dancing. He called one of the servants, and soon learned what was afoot. He became angry, and refused to go inside; and so his father came out, and entreated him to join the celebration.

But the older son answered his father, and said, “I have served you all of this time, and you never killed a goat for me so that I could have a feast with my friends. But this other son of yours, who has devoured all of your money with harlots – when he came home, you killed for him the fatted calf.”

And the father said unto him. “Son, you are right. I have been a fool, and I have paid too much heed to my emotions.” And the father went inside, and took the clothes and the ring from the younger son, and cast him out from his lands. And he called the friends of his older son, and the feast continued in the honor of the son who deserved it.

ANDREW: But you changed the story! That isn’t how it ends – the father doesn’t agree with the older son. He says it is right for them to celebrate, for “thy brother was dead, and is alive again; he was lost, and is found.” And most readers assume that at that point, the older brother realizes that he has been acting like a two-year-old.

CNC: Look, I’m not like Ayn Rand or Ludwig von Mises. I don’t think that being a libertarian is incompatible with being a Christian. But since, as Mises put it, “all efforts to find support for the institution of private property… in the teachings of Christ are quite vain,” it is true that the New Testament needs to be edited a little.

ANDREW: I’m sure you have other examples in mind.

CNC: Think about how much more inspiring the Sermon on the Mount would have been if Jesus had said: “Blessed are the rich in spirit, for as they lay up for themselves treasures upon earth, so they will also lay up for themselves treasures in heaven.”

The key is to realize that since libertarianism reconstructs all of ethics… in terms of a theory of property rights [200], it is fine to believe in Christianity – provided that whenever a correct understanding of property rights conflicts with Christianity, property rights shape one’s understanding of Christianity, and not the other way around.

ANDREW: This interview has become very interesting, but I’d still like to hear your answer to my original question about freedom.

CNC: Let’s see. As I’ve been trying to explain to you, due to democracy the genetic quality of the population has most certainly declined [185]. It is in the big cities… that the process of genetic pauperization is most advanced [184]. Now you asked me how I could support a future in which everyone would be free, but not everyone would be effectively free.

ANDREW: Yes.

CNC: What you have to understand is that I believe in negative liberty, not positive liberty. Everyone, even the most brutish individual, has a right to freedom, because that’s negative liberty – but effective freedom is a form of positive liberty, and so no one has a right to effective freedom. In fact, creating a right to effective freedom actually means coercing some people into doing forced labor for others.

ANDREW: I think I’m starting to see where this is going.

CNC: A member of the human race who is completely incapable of understanding the higher productivity of labor performed under a division of labor based on private property is not properly speaking a person… but falls instead into the same moral category as an animal – of either the harmless sort (to be domesticated and employed as a producer or consumer good, or to be enjoyed as a “free good”) or the wild and dangerous one (to be fought as a pest).

On the other hand, there are members of the human species who are capable of understanding the [value of the division of labor] but… who knowingly act wrongly… [B]esides having to be tamed or even physically defeated [they] must also be punished… to make them understand the nature of their wrongdoings and hopefully teach them a lesson for the future. [173]

Now yes, maybe some of these quasi-humans will be effectively slaves in a future libertarian society – but they have no right to be effectively free, nor have they done anything to earn effective freedom. In today’s America, the government expropriates more than 40% of the income of private producers, making even the economic burden imposed on slaves and serfs seem moderate by comparison [278]. In today’s America, everyone, even productive geniuses, is unfree – whereas in a libertarian society, everyone will be free, and people who deserve it will also be effectively free. Everyone will be better off.

ANDREW: Maybe I understand now. But don’t you ever wake up in the middle of the night and wonder if there isn’t as big a difference as you imagine between you and the people you see as human trash? Don’t you ever think that maybe, deep inside, they have the same dignity as you – or worry that in your future libertarian society they will be plunged into a living hell?

CNC: Look, am I my brother’s keeper?

Postscript

Nietzsche… has a description… of the disgust and disdain which consume him at the sight of the common people with their common faces, their common voices, and their common minds. …[T]his attitude is almost beautiful if we may regard it as pathetic… When he makes us feel that he cannot endure the innumerable faces, the incessant voices, the overpowering omnipresence which belongs to the mob, he will have the sympathy of anybody who has ever been sick on a steamer or tired in a crowded omnibus. Every man has hated mankind when he… has had humanity in his eyes like a blinding fog, humanity in his nostrils like a suffocating smell. But when Nietzsche has the incredible lack of humour and lack of imagination to ask us to believe that his aristocracy is an aristocracy of strong muscles or an aristocracy of strong wills, it is necessary to point out the truth. It is an aristocracy of weak nerves.

G. K. Chesterton, Heretics, p. 185 (published in 1905)

Notes:

“As Edward Banfield says in The Unheavenly City”

pp. 61-62 of that book (which Hoppe cites on p. 6 and again on p. 97).

“all efforts to find support for the institution of privateproperty… in the teachings of Christ are quite vain”

Ludwig von Mises, Socialism, Yale University Press, New Haven, 1951, p. 418.

“how much more inspiring the Sermon on the Mount would have been”

Instead, as Mises reminds us, “One thing of course is clear, and no skilful interpretation can obscure it. Jesus’ words are full of resentment against the rich…” (Socialism, p. 419).

Long Hoppe quote that begins “A member of the human race”

Paragraph break not in original, added for the sake of readability.

Simulposted at The Distributist Review

This is the sixth and final installment of an interview series. For the previous parts, see Part 1, Part 2, Part 3, Part 4 and Part 5. Red indicates exact quotes from Hans-Hermann Hoppe’s 2001 book “Democracy: The God That Failed.”

ANDREW: You’ve explained to me how in the libertarian society of the future, everyone will be free and their rights will not be violated. However, many people will be coerced in a noncoercive way, and a lot of people will be effectively slaves in a rights-respecting manner. Some people will be effectively killed in a rights-respecting manner. Why are you dedicating your life to making this society possible?

CODE NAME CAIN: I really take issue with the way you describe things. You twist words so that “freedom” and “rights” end up sounding like they are not always good things.

ANDREW: Can you just answer the question?

CNC: If you insist – but it will be a complicated discussion. To begin, [t]he natural outcome of the voluntary transactions between… private property owners is decidedly nonegalitarian, hierarchical, and elitist [71]. After all, the “permanently” rich and the “permanently” poor are usually rich or poor for a reason. The rich are characteristically bright and industrious, and the poor typically dull, lazy, or both. [96-97]

ANDREW: You talk almost as if lower-class people were so different from productive geniuses that they form a separate subspecies.

CNC: Well, there is something to that. As Edward Banfield says in The Unheavenly City, “if [the lower-class individual] has any awareness of the future, it is of something fixed, fated, beyond his control: things happen to him, he does not make them happen. Impulse governs his behavior, either because he cannot discipline himself to sacrifice a present for a future satisfaction or because he has no sense of the future.” Thus “permanent” poverty… is caused by… a person’s present-orientedness… (which is highly correlated with low intelligence, and both of which appear to have a common genetic basis) [97].

ANDREW: Are these ideas related to your criticism of democracy?

CNC: In a democracy, a politician understands that bums and inferior people will likely support his egalitarian policies, whereas geniuses and superior people will not. [145] For [this] reason… a democratic ruler undertakes little to actively expel those people whose presence within the country constitutes a negative externality (human trash which drives individual property values down). [145]

Therefore democratic rulers tend to subsidize bums, and every subsidy always produces more of the behavior subsidized – whether good or bad. By subsidizing with tax funds (with funds taken from others) people who are poor (bad), more poverty will be created. By subsidizing people because they are unemployed (bad), more unemployment will be created. [195] As a result of subsidizing… the careless, …the drug addicts, the Aids-infected, and the physically and mentally “challenged” though insurance regulation and compulsory health insurance, there will be more… carelessness, …drug addiction, Aids infection, and physical and mental retardation. [99]

Thus we see that the welfare state promotes the proliferation of intellectually and morally inferior people, and the results would be even worse were it not for the fact that crime rates are particularly high among these people, and that they tend to eliminate each other more frequently. [185]

ANDREW: I bet you even have scientific “studies” backing up these conclusions.

CNC: Yes, research bears out my claims. Take Banfield’s The Unheavenly City, or Murray and Herrnstein’s The Bell Curve, or Seymour Itzkoff’s The Decline of Intelligence in America. Have you read them?

ANDREW: No.

CNC: Will you?

ANDREW: Maybe. The Unheavenly City at least looks entertaining, whereas The Bell Curve looks long and boring.

CNC: If you read them from an unbiased point of view and you are persuaded that many lower class people are intellectually degenerate, will you change your views on democracy?

ANDREW: No. I expect that the arguments will be full of holes, but even if I can’t find any obvious flaws in the logic, I will still treat people who live in the projects as if they are human beings in the full sense of the word.

CNC: See? This is a classic case of evading ideas that threaten your personal world view. You have a quasi-religious attachment to the idea that all human beings have some sort of metaphysical “spark” or “spirit” that gives them value, and that leads you to close your mind and refuse to take an unbiased look at unorthodox viewpoints.

ANDREW: You see yourself, instead, as understanding the world through logical deductions from objective facts and data.

CNC: No. The problem is that [t]he data of history are logically compatible with… rival interpretations, and historians… have no way of deciding in favor of one or the other [xv]. We may agree… that feudal Europe was poor, that monarchical Europe was wealthier, and that democratic Europe is wealthier still… Yet was Europe poor because of feudalism, and did it grow richer because of monarchy and democracy? Or did Europe grow richer in spite of monarchy and democracy? [Rockwell overview] But there is a way out of this impasse.

The key is to rely upon a priori theory, i.e., propositions which assert something about reality and can be validated independent of the outcome of any future experience [xv]. Examples of such propositions include: No two lines can enclose a space. Whatever object is red all over cannot be green… all over… 4=3+1…. A priori theory trumps and corrects experience (and logic overrules observation), and not vice-versa. [xvi] This procedure is what Ludwig von Mises called praxeology.

ANDREW: This is fascinating.

CNC: What is more, praxeology includes similarly definitive propositions that are valid in the social sciences. For instance, a larger quantity of a good is preferred to a smaller amount of the same good; … an increase in the supply of paper money cannot increase total social wealth … Taxes… reduce production and/or wealth below what it otherwise would have been. [xvii, Rockwell]

ANDREW: So if someone does a study that shows that the Fed increased the money supply and the economy prospered, then…

CNC: Then since an increase in the paper money supply cannot lead to greater prosperity [Rockwell], we can be praxeologically certain that any increase in prosperity took place despite the increase in the money supply. Similarly, the improvement in living standards from the feudal period until today must have occurred in spite of democracy, not because of democracy.

ANDREW: How is praxeology viewed in the academic world?

CNC: Many reactions are dismissive. However, although mainstream economists refuse to recognize their debt to Mises, I am personally convinced that many of them are closet praxeologists.

ANDREW: Can you demonstrate for us how praxeology works? For instance, can you praxeologically prove to us that government regulation is always bad for the economy?

CNC: Of course – but you’ll have to conquer your math phobia and be willing to study a couple of graphs.

ANDREW: I guess I can make the effort, if it’s essential to the explanation.

CNC: Then let’s begin. Consider the following two time preference graphs. In both graphs, as the person gets richer, the person is more likely to be focused on the future and not just on immediate gratification.

The green curve represents a person (for example, an uncivilized man or a bum) who, even if rich, still may not care about anything but the present and the most immediate future. Like a child, he may only be interested in… minimally delayed gratification. In accordance with his high time preference, he may want to be a vagabond, a drifter, a drunkard, a junkie, a daydreamer, or simply a happy-go-lucky kind of guy who likes to work as little as possible in order to enjoy each and every day to the fullest. [5]

On the other hand, the gold curve represents a more mature person (for example, a productive genius) who, even when poor, does not merely focus on the present moment, but instead worr[ies] about his and his offspring’s future constantly [5].

Now I can explain why government regulation always reduces living standards. First of all, if a society is future-oriented (like the productive genius), then it will prosper. If it is focused on immediate gratification (like the bum), then it will stagnate. Time preference (whether someone is exclusively focused on the present moment, or whether they also consider the future) is the key factor that determines which societies succeed.

ANDREW: Being future-oriented is the only thing that matters? It doesn’t matter whether a country has honest people, or the freedom to discuss new ideas?

CNC: Respect for property rights inevitably leads to a culture of integrity, so your point is irrelevant. Returning to the subject, when you add government regulation to the picture, there are two effects. First, regulation interferes with private property rights. That effectively reduces people’s wealth. That makes people poorer. Poorer people are more needy, and so they are more focused on where their next meal is coming from. In other words, they are more focused on instant gratification.

ANDREW: How does the government telling a garbage company that it can’t dump toxic sludge in a river make the people in the country more focused on instant gratification?

CNC: Stop interrupting – you might learn something. The second way that regulation destroys prosperity is also important. When the government regulates people, they know that their property rights have been violated – and they also know that the government might violate their rights in the future – but they don’t know when those future rights violations will occur! So their uncertainty increases. They respond by associating a permanently higher risk with all future production [14] and become more focused on immediate gratification.

ANDREW: Suppose bank examiners go around and make sure that banks are not making dangerous or illegal loans with depositors’ money. How does this make depositors more uncertain about the future? How does this make banks more uncertain about the trustworthiness of other banks?

CNC: If you are sincerely interested in understanding the answers to those questions, you can always pick up an economics textbook. Anyway, we can elegantly sum up both of these effects of regulation in the following graph:

The first effect makes productive geniuses poorer, and so causes their time preference to rise along the gold curve, from point X to point Y. The second effect makes productive geniuses more focused on immediate gratification and so causes them to act more like bums. In other words, it leads to a rise in time preference schedules, moving from point Y on the gold curve to point Z on the green curve. The rise in time preference rates from Z to X means the society has become much more focused on instant gratification – and this rise is directly traceable to the pernicious effects of government regulation. With this rise in time-preference, the progress of civilization slows, and may even go into reverse: formerly provident providers will be turned into drunks or daydreamers, adults into children, civilized men into barbarians, and producers into criminals [15].

ANDREW: Your argument is not very convincing. It is built out of a series of assertions, and none of the assertions makes sense. The argument with the graphs is exactly the same, but with graphs.

CNC: When I argue by citing scientific evidence, you refuse to consider it. When I argue praxeologically, and produce a chain of logic that compels assent, you claim to be unable to understand the reasoning. Still, I will try one more time. If logic is difficult for you, why don’t I illustrate my point through a story?

ANDREW: Why not?

CNC: Once upon a time, there was a certain man, and he had two sons. The older son stayed at home and worked hard and did whatever his father wanted. But the younger son got bored of life at home, and asked for his portion of the inheritance. The father consented, and the younger son left. He took a journey into a far country, and there wasted his money in riotous living.

The younger son became hungry, and in order to survive, he took a job feeding hogs. But he still did not have enough food to eat, and decided to return to his father.

And he arose, and came to his father. But when he was yet a great way off, his father saw him, and had compassion, and ran, and fell on his neck, and kissed him. And the son said unto him, “Father, I have sinned against heaven, and before thee, and am no more worthy to be called thy son: make me one of thy hired servants.”

But the father said to his servants, “Bring forth the best robe, and put it on him; and put a ring on his hand, and shoes on his feet. And bring the fatted calf, and kill it; and let us eat, and be merry.”

Now the older son was in the field, and as he came and drew nigh to the house, he heard music and dancing. He called one of the servants, and soon learned what was afoot. He became angry, and refused to go inside; and so his father came out, and entreated him to join the celebration.

But the older son answered his father, and said, “I have served you all of this time, and you never killed a goat for me so that I could have a feast with my friends. But this other son of yours, who has devoured all of your money with harlots – when he came home, you killed for him the fatted calf.”

And the father said unto him. “Son, you are right. I have been a fool, and I have paid too much heed to my emotions.” And the father went inside, and took the clothes and the ring from the younger son, and cast him out from his lands. And he called the friends of his older son, and the feast continued in the honor of the son who deserved it.

ANDREW: But you changed the story! That isn’t how it ends – the father doesn’t agree with the older son. He says it is right for them to celebrate, for “thy brother was dead, and is alive again; he was lost, and is found.” And most readers assume that at that point, the older brother realizes that he has been acting like a two-year-old.

CNC: Look, I’m not like Ayn Rand or Ludwig von Mises. I don’t think that being a libertarian is incompatible with being a Christian. But since, as Mises put it, “all efforts to find support for the institution of private property… in the teachings of Christ are quite vain,” it is true that the New Testament needs to be edited a little.

ANDREW: I’m sure you have other examples in mind.

CNC: Think about how much more inspiring the Sermon on the Mount would have been if Jesus had said: “Blessed are the rich in spirit, for as they lay up for themselves treasures upon earth, so they will also lay up for themselves treasures in heaven.”

The key is to realize that since libertarianism reconstructs all of ethics… in terms of a theory of property rights [200], it is fine to believe in Christianity – provided that whenever a correct understanding of property rights conflicts with Christianity, property rights shape one’s understanding of Christianity, and not the other way around.

ANDREW: This interview has become very interesting, but I’d still like to hear your answer to my original question about freedom.

CNC: Let’s see. As I’ve been trying to explain to you, due to democracy the genetic quality of the population has most certainly declined [185]. It is in the big cities… that the process of genetic pauperization is most advanced [184]. Now you asked me how I could support a future in which everyone would be free, but not everyone would be effectively free.

ANDREW: Yes.

CNC: What you have to understand is that I believe in negative liberty, not positive liberty. Everyone, even the most brutish individual, has a right to freedom, because that’s negative liberty – but effective freedom is a form of positive liberty, and so no one has a right to effective freedom. In fact, creating a right to effective freedom actually means coercing some people into doing forced labor for others.

ANDREW: I think I’m starting to see where this is going.

CNC: A member of the human race who is completely incapable of understanding the higher productivity of labor performed under a division of labor based on private property is not properly speaking a person… but falls instead into the same moral category as an animal – of either the harmless sort (to be domesticated and employed as a producer or consumer good, or to be enjoyed as a “free good”) or the wild and dangerous one (to be fought as a pest).

On the other hand, there are members of the human species who are capable of understanding the [value of the division of labor] but… who knowingly act wrongly… [B]esides having to be tamed or even physically defeated [they] must also be punished… to make them understand the nature of their wrongdoings and hopefully teach them a lesson for the future. [173]

Now yes, maybe some of these quasi-humans will be effectively slaves in a future libertarian society – but they have no right to be effectively free, nor have they done anything to earn effective freedom. In today’s America, the government expropriates more than 40% of the income of private producers, making even the economic burden imposed on slaves and serfs seem moderate by comparison [278]. In today’s America, everyone, even productive geniuses, is unfree – whereas in a libertarian society, everyone will be free, and people who deserve it will also be effectively free. Everyone will be better off.

ANDREW: Maybe I understand now. But don’t you ever wake up in the middle of the night and wonder if there isn’t as big a difference as you imagine between you and the people you see as human trash? Don’t you ever think that maybe, deep inside, they have the same dignity as you – or worry that in your future libertarian society they will be plunged into a living hell?

CNC: Look, am I my brother’s keeper?

Postscript

Nietzsche… has a description… of the disgust and disdain which consume him at the sight of the common people with their common faces, their common voices, and their common minds. …[T]his attitude is almost beautiful if we may regard it as pathetic… When he makes us feel that he cannot endure the innumerable faces, the incessant voices, the overpowering omnipresence which belongs to the mob, he will have the sympathy of anybody who has ever been sick on a steamer or tired in a crowded omnibus. Every man has hated mankind when he… has had humanity in his eyes like a blinding fog, humanity in his nostrils like a suffocating smell. But when Nietzsche has the incredible lack of humour and lack of imagination to ask us to believe that his aristocracy is an aristocracy of strong muscles or an aristocracy of strong wills, it is necessary to point out the truth. It is an aristocracy of weak nerves.

G. K. Chesterton, Heretics, p. 185 (published in 1905)

Notes:

“As Edward Banfield says in The Unheavenly City”

pp. 61-62 of that book (which Hoppe cites on p. 6 and again on p. 97).

“all efforts to find support for the institution of privateproperty… in the teachings of Christ are quite vain”

Ludwig von Mises, Socialism, Yale University Press, New Haven, 1951, p. 418.

“how much more inspiring the Sermon on the Mount would have been”

Instead, as Mises reminds us, “One thing of course is clear, and no skilful interpretation can obscure it. Jesus’ words are full of resentment against the rich…” (Socialism, p. 419).

Long Hoppe quote that begins “A member of the human race”

Paragraph break not in original, added for the sake of readability.

Posted: 05 Dec 2011 11:33 PM PST

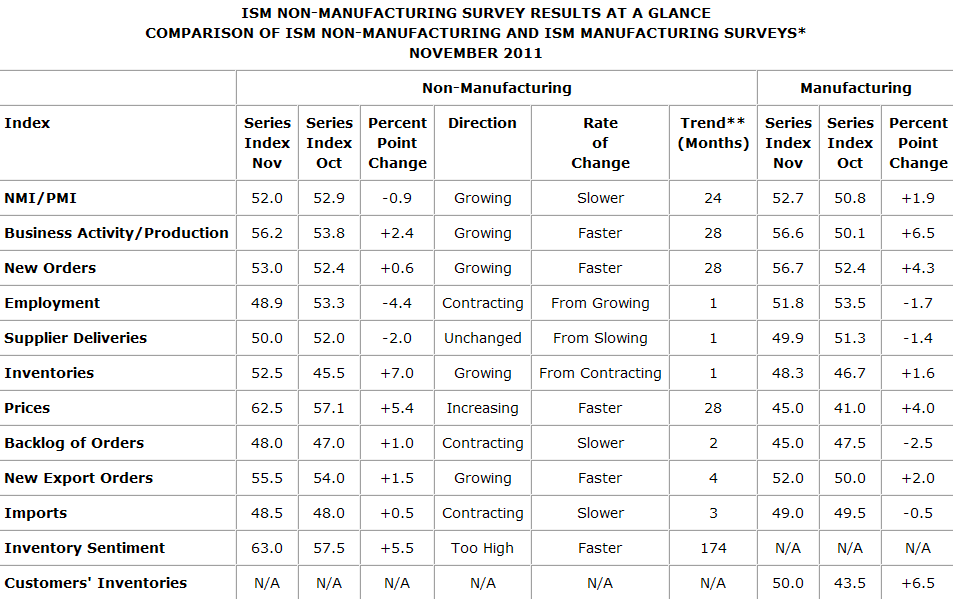

By David Llewellyn-Smith, the founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. He is also the co-author of The Great Crash of 2008 with Ross Garnaut. Cross posted from MacroBusinessSo, global PMIs for November have passed. Where do they suggest that the global economy is heading? Let’s begin with the good news, the US of A. The combined ISM Manufacturing and Services Indexes are below:

The headline figure for manufacturing lifted modestly and it contracted modestly for services. New orders improved for both but so too did inventories. Less promising is that employment for manufacturing collapsed into contraction and services went close as well. Clearly, US businesses are not confident enough about the current bounce to hire into it.

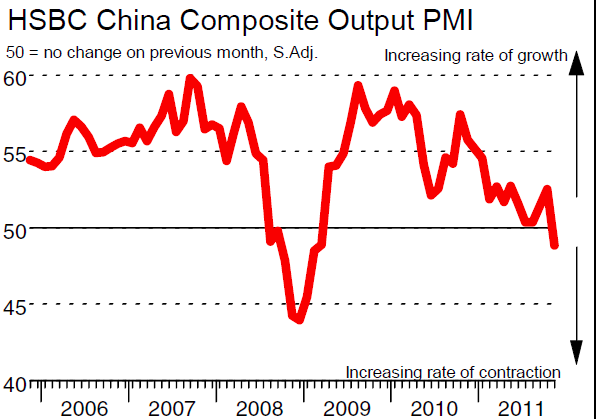

So much for the good news. Let’s cross the Pacific to North Asia where we find China really struggling. We already know about the plunge of the manufacturing PMI from 51 to 47.7 last week. Yesterday we added the Services PMI which recorded a moderate fall from 54.2 to 52.5, still expanding. But the composit PMI that combines the two give you an idea of the current trajectory of the Chinese economy:

That’s 48.9, down from 52.6. Chinese business is not enjoying itself just now. Although, the sub-component employment indexes showed that maufacturing is not yet shedding jobs although the jumping inventory ratios suggest they will shortly, and services are expanding the fastest since June. Authorities have begun to ease the foot off the break but so far, minimally and if we are to take them at their word, it will be a slow easing.

This China slowdown has hit the rest of Asia hard with manufacturing contracting in Japan, Korea and Taiwan. All three reported flat employment indexes.

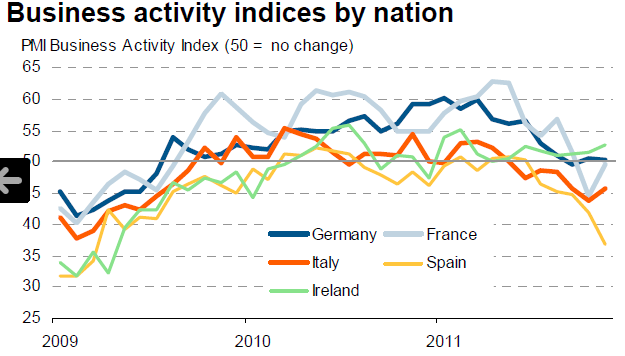

Swinging to Europe, we know that maufacturing is contracting fast, down from 47.1 in October to 46.4 in November. The employment sub-index reported active job losses as busiensses became more cautious. Last night we added the services PMI and the result was a weak 47.5, slightly up from 46.4 in October.

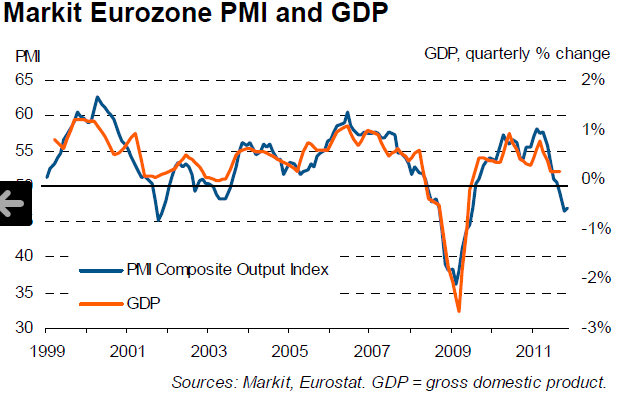

The core nations of Germany and France added jobs whilst Ireland, Spain and most dramtically Italy shedded jobs. The composit PMI for the Eurozone now looks like it’s projecting a mild recession:

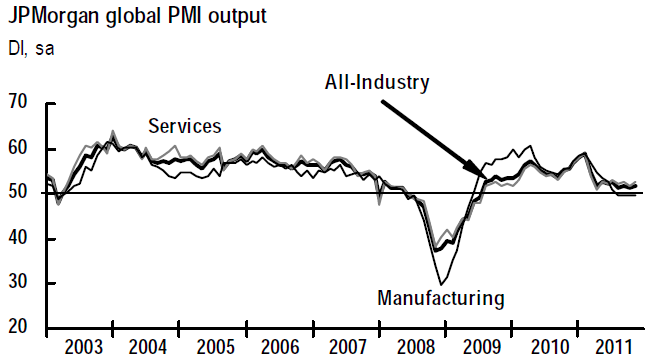

So, where does that leave world growth? First, the global economy for services:

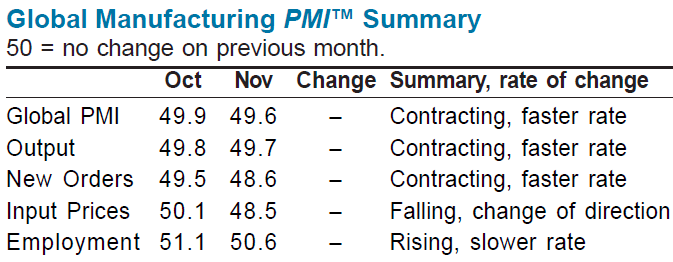

Still expanding at a crappy pace but note the employment index turning negative. Next, the global economy for manufacturing:

Activity contracting with the employment index heading that way as well. That all adds up to this insipid growth:

A flatline in global PMIs within which there has been significent churn, with the EZ and China falling and the US rising.

So, what does all of this say about the global business cycle? Firstly, we’d have to say that without the US, global production would be in big trouble. Everywhere else is slowing swiftly. I’d describe where we are as stall speed for the global economy. In my view, it cannot stay here sustainably. Either employment losses will accererate as businesses seek to claw back profits lost to declining demand or the new stimulus that’s being pumped in will turn demand around, lift production and job creation as inventories fall. Unfortunately, the Eurozone is doing the opposite of stimulus: austerity. Likewise, China’s seeming determination to keep a lid on property is preventing any rapid loosening there too. My bet remains, therefore, that we see further slowing from here into next year irrespective of any credit event that would repeat 2008′s dizzying plunge.

No comments:

Post a Comment